Investor reporting and reconciliations for the Mortgage Servicing Industry

Let QIE Partners Handle Your Investor Reporting and Reconciliations

Our services to the Mortgage servicing industry

Bank Account Reconciliations

QIE Partners reconciles Principal and Interest (P&I) accounts, Taxes and Insurance (T&I) accounts, clearing accounts, and mortgage servicing general ledger accounts.

Mortgage Servicing Investor Reporting

QIE Partners provides investor reporting services for single-family residential mortgages to Fannie Mae, Freddie Mac, Ginnie Mae, Federal Home Loan Bank Board, and private investors.

Fannie Mae Portfolio Reconciliations

Servicers are required to complete Fannie Mae Schedules each month. QIE Partners provides this service. We have good working relationships with Fannie Mae representatives.

Audit Services

QIE Partners is a valuable resource for Mortgage Servicers who have severe audit findings from government agency investor audits.

Operational Reviews

QIE Partners offers operational reviews for all areas of Investor Accounting, including investor reporting, remitting, and bank reconciliations.

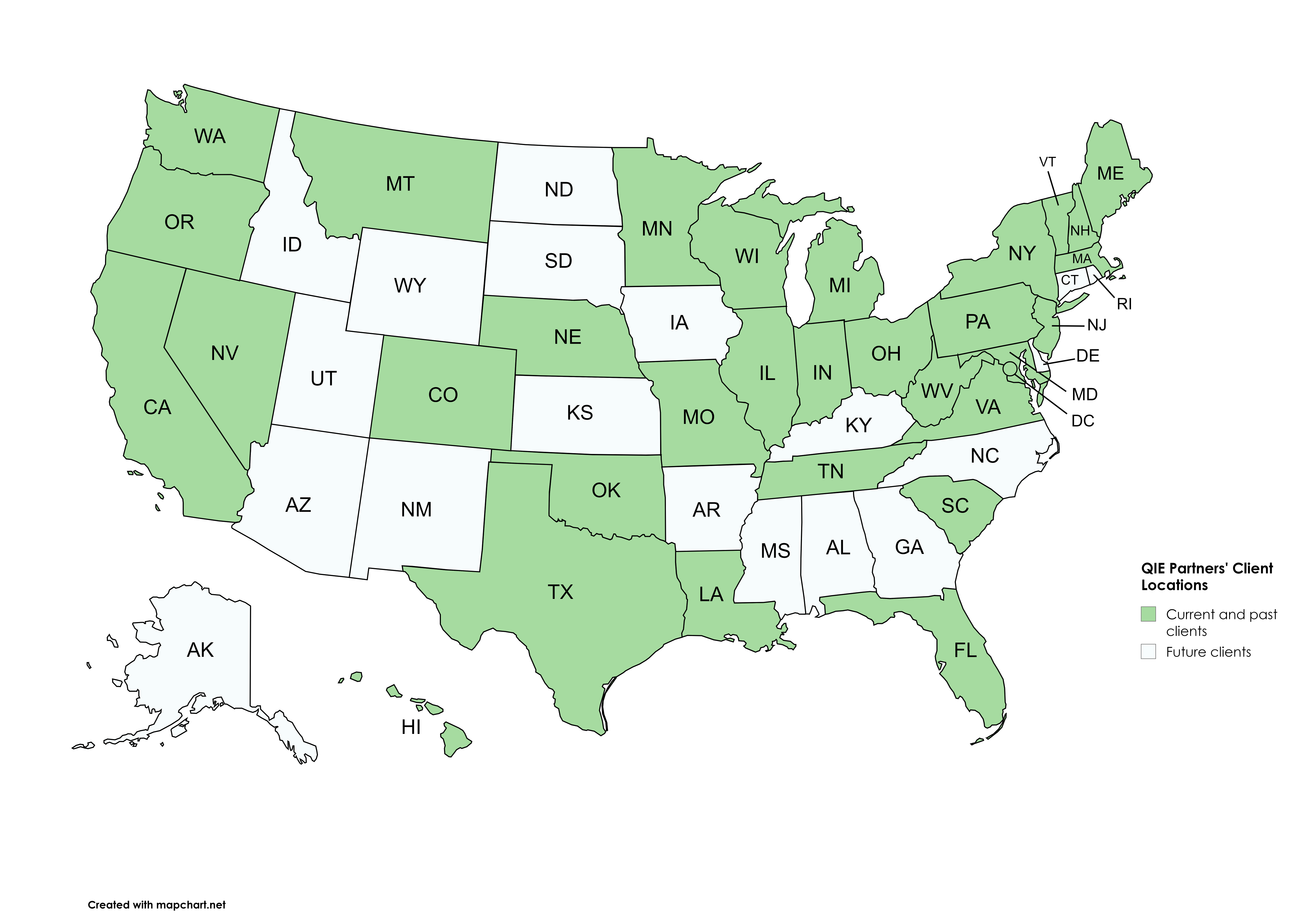

QIE Partners’ Reach is Nationwide

QIE Partners helps banks, credit unions, and mortgage companies improve and streamline their mortgage servicing processes. We offer the highest quality of investor reporting services, custodial bank reconciliations, clearing account reconciliations, and Fannie Mae Schedule services to help our clients achieve the highest ratings on investor scorecards.

Reasons why Clients Hire Qie Partners

The statements on this page are direct quotes from our clients, which include banks, credit unions and mortgage companies. Due to the confidential nature of our business and in accordance with client agreements, we will only provide a client’s name upon express written permission from that client.

In the near future, Fannie Mae will automatically draft your P&I Custodial account for actual/actual loans.

Have you prepared processes for this change?

Copyright © 2024 QIE Partners. All Rights Reserved.

Phone (303) 808–5878

PO Box 100945, Denver CO 80250